Are we at the Top Yet?

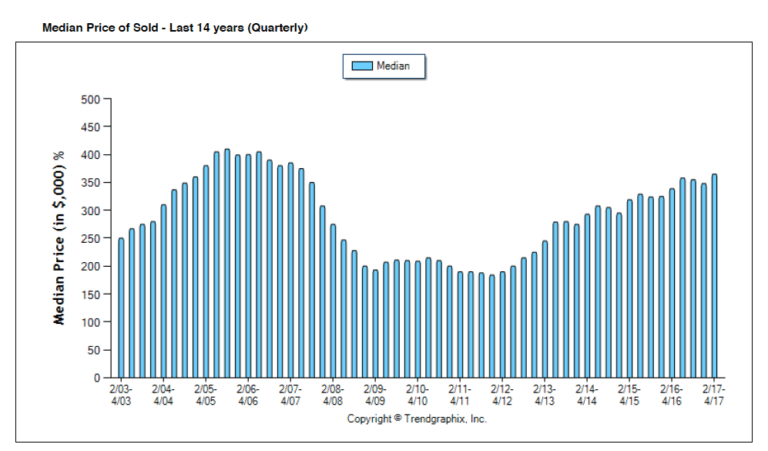

Over the past couple weeks I have been asked this question by a multiple of friends, clients and business people that I respect. How much higher can the market go? Having sold lots of listings his year with multiple offers and bidding wars, even I am starting to wonder. Is this 2004, 2005, 2006 all over again? Déjà vu.

My honest answer is I do not know. What I do know is that the underlying financing for most homes sold after 2008 is fundamentally sound. In other words, the only way these home owners will face foreclosure is if there is a major change in their lives or financial situation. Foreclosures will not start up simply because of interest rate adjustments on variable rate teaser loans that were given away 12 or 13 years ago.

Also, our area is growing and the economy seems to be strong. People are moving to the area, which is creating demand for more housing. This can also be seen in rental rates increasing. So for now, the economy seems positive.

I have lived through 2 real estate market crashes. In the early 1990’s the market dropped. The cause was a recession coupled with the closure of the Army Depot, Mather Air Force Base and McClellan Air Force Base. All resulted in high unemployment for the area.

Then in 2006 & 2007 the market really crashed primarily due to the easy money banks and mortgage lender were willing to give away. The result, people buying homes they could not afford under traditional lending standards.

In both cases, builders were going gang busters. They were building everywhere. This created an over supply problem when demand suddenly slowed down or stopped.

The question I have been rustling with is, “if the real estate market does crash, what will cause it?” What is the spark that will cause demand to suddenly slow down or stop?

Here are a couple possibilities, and there could be more:

Interest rates – Rates are still low and I have to believe the Federal Reserve is not going to dramatically increase them. But if rates do go up 1 or 2%, it will have a dramatic impact on affordability, especially at the price levels we have today.

Over Building – Are the builders providing supply at too fast of a rate? This is hard to say. For the most part, builders are not suppling homes under the $400,000 price point in Placer County. So for Placer County, even if the $400,000 price range and up slows down, there is still a lot of demand for the sub $400,000 price point. I do see some builders with a few Move-In ready homes (unsold inventory). But I have to believe that after the recent market crash hangover, builders will be very cautious about over building.

Hedge Fund Investors – Let’s not forget the 1,000s of homes hedge funds bought up when the market bottomed out. Those homes are still out there and could potentially come onto the market when these funds decide to liquidate. I have not heard of any doing so at this time, but it is something to keep in eye on.

Who knows what will happen. My 10 cents worth of advice:

1. Look at your long range plans. If you plan to own the home for 5 or more years, then you should be safe. Real estate has a history of appreciating over time. As the saying, God ain’t making any more.

2. Never put yourself in the position that you HAVE TO SELL. If you have to sell and the market is not in your favor, you lose. If you are in a position to ride the market, over time you will win.

3. If you are making a local move up or down, it really does not mater. Your home’s value will change relative to other home values within the region.

Have a great week,

Chris DeMattei

Despite having a double-digit decline in the first half of the year, California home sales only dipped slightly in 2019 as low interest rates boosted the market in the last six months of the year. With the average 30-year fixed-rate mortgage (FRM) dipping more than 100 basis points from the prior year for three consecutive months at the year-end, buyers became more motivated to get back in the market and lifted sales up. December sales were up strong from 2018 with a jump of 7.4 percent, the largest increase since November 2016. For the year as a whole, there were 397,910 existing single-family homes sold in California in 2019, a drop of 1.2 percent from 402,640 units in 2018. Home prices also ended the year strong as costs of borrowing remain low. California had its first double-digit increase in price in more than 5 1⁄2 years. The statewide median price increased 10.3 percent from December 2018, and the increase was the largest since May 2014. For the year 2019, California recorded a median price of $592,450, an annual increase of 4 percent from 2018. With low rates making mortgage payment more affordable, buyers have more room to offer a higher bid in a market that has become more competitive in recent months. So, what should we expect in 2020? In the next few months, the market momentum from last year will likely be carried forward to 2020, with both sales and prices continuing to grow. The upward trend in pending sales at the end of 2019 suggests that the California market will kick off 2020 with a strong start, while elevated price levels on properties listed for sale indicate that moderate price growth on closed sales will continue. With the Federal Reserve policy on cruise control and the economy growing at a mild but steady pace, mortgage rates will stay near a historical low as the market continues to search for its direction. The average 30-year FRM will likely stay below 4 percent for most of 2020. Just like any other year, there are risks and uncertainties to the market. Supply remains one of the biggest issues in California. With active listings dropping more than 20 percent at the end of last year, inventory fell to the lowest level since December 2017. Supply will likely tighten up further in 2020 and could stifle sales growth and create affordability issues as market competition remains heated. Macroeconomic factors also create downside risks to the outlook. Stock market fluctuations and the economic impact of coronavirus are two unknowns that could have negative effects on the market. Political uncertainties – such as the geopolitical tension between the U.S. and Iran, as well as the Presidential election – could also impact the housing market on the downside. All things considered, market conditions look better in 2020. COPYRIGHT © CALIFORNIA ASSOCIATION OF REALTORS®

The holiday season is all about fun and merriment, but if we’re being honest, it can get intense. A towering to-do list, complicated family dynamics, and excess everything can get overwhelming and stressful before you know it. Too often we get swept up in the whirlwind of activities and get sidetracked from the habits and routines that keep us happy and heathy in our daily life. But it’s totally possible to both win at the holidays and do it in a way that won’t make you feel depleted. 1. Take time for yourself “Tis the season for giving”, but the holidays are the time when it’s easy to get extra stressed out from over- giving. If you already have a habit in your daily life of committing too much to others, this season will kick those tendencies into high gear. Maxing out emotionally and physically can be a real side effect of all the holiday cheer if you don’t take time to recharge. Schedule an evening by yourself that’s just about rest and relaxation. Take a bath, read a book, meditate, or just go to bed early. 2. Don’t wait until the last minute Whether it’s shopping, cooking, or decorating, it’s a good idea to get ahead of the game as much as possible. After you’ve made your list of everything you have to buy or do, map out a plan. It may feel super overwhelming in your head, but when you break it down (and even figure out where you may be able to delegate to others), the whole thing will feel much more approachable. Getting a head start will also help your budget, because you’ll be less likely to go for those frantic impulse buys at the cash register. 3. Make a to-do list When you start to feel overwhelmed, break down your tasks into manageable lists that you can tackle one by one. It will make everything so much easier and will keep you on track. Cross each line item off after you finish it and give yourself a pat on the back when you’re finished so you have a sense of accomplishment. 4. Have fun, but be prepared With one cocktail party after another, the celebratory vibe of this season can put a real drain on your body. Excess alcohol, sugar, and carbs will leave you feeling bloated and tired, and will make your January gym resolutions that much harder. Counteract the dehydrating effects of one-too-many-cocktails with lots of fresh water and healthy, protein-rich food when you’re not in party mode. 5. Draw healthy boundaries with your loved ones The holidays can be a challenging time when it comes to dealing with family members, especially if you’re already feeling overwhelmed. Old patterns and relationship dramas can pop up again before you know it. Make sure to be clear with family members about your needs and boundaries and open up the channels of communication as best as possible. 6. Move Your Body In this season of indulgence, it’s super important to keep up your regular physical activity to balance your mind, body, and spirt. Take time to exercise—whether it’s a HIIT class or just a brisk walk—to help bring stress levels down. In addition to boosting your serotonin levels, interactive exercise (think touch football or a Zumba class) can also be a fun bonding activity with your S.O. or family member when you’ve been stuck in the house for too long. 7. Get out in nature Christmas shopping is always a little stress-inducing, from dealing with crowds at department stores to overloading on online purchasing. Take a break from the consumer craziness with some fresh air, whether it’s a hike in the woods or just a bundled-up stroll through a park. The slower pace and lack of screens (try to take a break from your phone as well) will help you come back to your senses. 8. Let go of perfection When you feel yourself starting to go down the rabbit hole of stress around the holidays, take a step back and reevaluate. Is it really that important to get the perfect glass-blown ornament for your Christmas tree or a specific hard-to-find cheese for your appetizer spread? While big dinners and gatherings are a highlight of this time of year, the endless details are not worth losing sleep over. Take stock of what really matters—spending time with loved ones—and don’t compare yourself to anyone else. Wishing you and your loved ones a very Merry Christmas! Chris, Cendrinne, Becky and Christi

Sometimes life takes us on paths we had not planned; a sick spouse, aging parent or kids who grow up and move out (hopefully). It’s during these times that we need to think about our current living situation and decide if it still works for us. Oftentimes it’s a job change or retirement that has us thinking about making a change. And even though some of these life transitions are positive, they can often be difficult. Chris and I are in that situation right now, after living in our current home for over 15 years I want to move and Chris does not. This is a very common dilemma with couples we see in our real estate business. Usually one spouse wants a change and the other does not – that could be another blog, at another time. But in our case, I want to move for a couple of reasons. I love our house and neighborhood but as our only daughter is turning into an adult and will eventually move out, I’m ready to move to a smaller house. A deeper more personal reason is because this house reminds me of all the fun times I had as a stay-at-home mom doing all those activities that we do while caring for our children. Play groups, bible-study groups, kid’s birthday parties and such all took place in that home and as I now want to expand my business career, I feel the need to make a change. I want to embrace the empty nest phase of our life and finding a home that’s easier to take care of and one-story with one great room for entertaining. We’ve agreed to wait until our daughter actually moves out, before moving from the home she grew up in. Here are a few things I would recommend if you are facing a life transition that may require you to move to a new home: 1.) If you are a couple, make sure you are both in agreement to make the change. It’s very difficult for a real estate agent to help a couple find a new home if one partner is resistant to the move. This is why agents will ask that both partners be present for pre-listing meetings or home showings. It’s heartbreaking to see one partner find the home of his or her dreams only to have the other partner balk. 2.) Do not make the decision while you are in the midst of the life transition. No one can think clearly when the stress of a new job or an illness of a family member is on one’s mind. If at all possible, wait until things have settled down and you are into your new routine or job before embarking on a new home search. 3.) When considering a new neighborhood, town or city, visit that area often and at different times. Driving around the neighborhood during the middle of the week does not give you a good sense of traffic, noise, cars parked on street, etc. Make a visit during the evening or weekends to see what kind of activity occurs when neighbors are home. It’s also a good time to talk to someone who lives in the area if they happen to be out in their yard. 4.) Don’t be afraid to talk to an agent about your desires or plans to move even if it will not occur for a year or so. We have many homeowners who we have kept in touch with over the years. We provide market updates, share recent home sales and provide any home repair information to help them get ready for the future change. We have seen homeowners decide to stay in their homes after remodels, improvements or repairs have taken place. 5.) If you are considering a home change in the future, let us know. We would be more than happy to make a visit and provide you with information that could help you with that decision.

Helping your aging parents prepare to sell and move into either independent or assisted living is not easy, even if they are willing to make that move. And over the years, we’ve seen many situations where adult children need to step-in to assist. Sometimes a parent dies and the family members are left with dismantling a home that has been lived-in for 20, 30 or 40 plus years. Any one of these scenarios can be overwhelming for not only the aging individuals but most of the family members as well. Begin clearing out the home now. One of the biggest hurdles that family members experience when facing an upcoming move for their parents is the massive amount of accumulated personal belongings in the home. Years and years of memories, mementos and hobby supplies fill every room. Oftentimes, elderly people begin collecting everyday items; paper bags, boxes, canned goods or paperwork. Piles and piles of items that need to be sorted, stored or disposed of. Clearing one room or area at a time and not waiting until needing to make the move is one of the best, first steps to take. Make sure the property is held in a trust. Should you be dealt with the unfortunate situation of the death of an elderly parent, the sale and managing all aspects of transferring the property will be much easier if it is in a trust. An estate attorney can advise you and your family members of the best way to set-up a trust account. If the property is already set-up as a trust, be sure to locate the trust agreement paperwork. In addition, help locate and store in a safe place all valuable and important paperwork, if possible. Should you need to sell the parent’s home, interview several licensed, real estate agents to ensure that you have someone who understands how to work with a senior homeowner. There are agents who are experienced or are certified in this area. Always, if possible, have another family member with the elderly parent when an agent visits the home to ensure information is accurately noted and to make sure all documents that are signed are correct. Enlist the help of a Senior Care Advisor (SCA). It is often helpful to have a professional, non-family member assist the elderly parent with information, support and advice. Finding a new place to live can be time-consuming and visiting several facilities exhausting. A SCA can narrow-down the search to a place that meets the needs of your family member. This service is often free as the SCA is compensated by the senior living facilities they recommend. Get references before using someone to help in this area. If you are faced with the need to assist your parents for an upcoming move and need references, let us know. We have several elderly care business associates that we have used, and we’d be happy to share that information with you. Begin preparing for your parent’s move now and you’ll be able to help them ease into this transition going forward.

The real estate market continues to appreciate as it has ever since it bottomed-around 2011. The rate of appreciation has been slowing over the past 2-3 years and I predict this trend will continue. There are three main reasons for this: 1.) Affordability – as prices increase, it becomes harder for buyers to qualify. As a result, fewer buyers can afford to purchase. 2.) Interest rates – rates went up last year which caused a slowdown in sales and appreciation. Although we did see rates decline at the beginning of the year, I anticipate them to increase as the economy continues to improve. 3.) Increase in new home inventory – prices have reached the point to where builders can build and make a profit. The result is a lot of builders have entered the market and are building. Buyers have many options when it comes to new construction. My belief is that the market will continue to remain stable. It will not be a seller’s market as it has in the past nor will it be a buyer’s market and here’s why: The economy and jobs market are doing well. As long as there is a strong job market regionally, the area will grow and there will be continued demand for housing. Sellers will not be forced to sell. Inventory will not spike up like it did in 2006 and 2007 because sellers will only sell if it makes financial sense. Buyers will not purchase unless they qualify for a loan and feel comfortable with the payment levels. Lastly, the Sacramento and Placer regions continue to grow. The economy is strong and we are seeing job growth. The region continues to benefit from people leaving the bay area looking for a higher quality of living. Builders are building, lenders are loaning money, and people are buying and selling. Yet it all seems to be fundamentally sound with very little to no speculation. This all adds up to a nice stable market into the near future. Given the current market condition, I plan to continue providing our clients with the information and advice they need to determine when, and if, they should buy or sell. If you desire to see if selling or buying real estate is the right thing for you in today’s market, give me a call. I would be happy to spend some time discussing your situation and options. Contact Now!

(Content Correction: Our recent blog on the Citrus Heights’ State of the City stated that the City will be facing a $65 mil deficit, the information should have read “The City needs $65 mil to do all of the road repairs in the City.” We apologize for any confusion this may have caused.) On June 11th, the Citrus Heights Chamber of Commerce held the Annual State of the City Luncheon at the Citrus Heights Community Center. Mayor Jeannie Bruins presented an overview of what the City accomplished, and defined the priorities and shared recent economic development and infrastructure improvements. In addition, the Mayor spoke about the upcoming challenges with balancing responsible financial management while seeking funding for community priorities with available resources. We obtained a copy of the PowerPoint presentation so here are some additional key components: – Public safety is a priority. Crime was reduced by 11% in 2018, and the new Rental Housing Inspection Program will ensure properties will be managed and maintained in the City. – Economic growth continues with 560 new businesses, the Sylvan Property Purchase, and the new medication office building which is coming soon. – Improvements in infrastructure includes the Highland Avenue Drainage Project, Mariposa 4 in design phase and the Mariposa 3 Safe Routes to School. – A revitalized focus on Sunrise Mall with efforts to collaborate with the many owners of the Mall. Mayor Bruins explained that as the City transitions to District Based Elections and improving the infrastructure, the City faces a $65 million funding gap. The City will continue its commitment towards improving public safety and working on homelessness. The Auburn Blvd. development efforts, with now 229 businesses, showed a 10% property value increase, in addition to the future Studio Movie Grill and plans for a new Hobby Lobby store. Efforts will continue to support businesses and the Chamber of Commerce. Conclusion In conclusion, the Mayor reminded the audience of the successes in becoming a City and securing our own police department. And that the City maintains a strong commitment to self-reliance and local control. Solid Roots and New Growth is the new motto and there are big plans in place for our future.

Friends and Clients — Fall is upon us, we have experienced the first big rain of the year, and with it the end of the high season for real estate. However, if you’re thinking you’ve missed your chance to sell your home, let me reassure you. This fall actually presents a fantastic moment to sell. Here’s why. First off, housing inventory is still incredibly low. In fact, according to data from the Sacramento Association of Realtors, inventory remains well below historic averages, and is 72% less than the peak in 2007. Second, while mortgage rates also remain very low, recent announcements by the Federal Reserve might cause them to finally start rising. This would make mortgages less affordable and might turn away a significant number of potential buyers. This is even more of a concern when you consider the continuing growth of home prices driven in part but the rising cost to build. Third, contrary to conventional wisdom, fall is generally a great time to list your home. Buyers in the fall are likely to be more serious because they have probably been searching for months without success. They may want to be in their new home by Christmas or before the end of the year. Also, because fewer homes are listed in the fall, this means there’s even less competition than we’ve seen due to the general low inventory. So what do you get when you put all those things together? Well, if you were to list your home right now, chances are good that you would be able to sell it very easily and for a top price. On the other hand, if you decide to wait, the situation might not be as favorable because mortgage rates might rise or because new construction might pick up. That means the time to list your home is now. You can get started with this home value calculator on my website, which takes into account recent sales specific to your neighborhood: Enter your street address here to find out what your home is worth This calculator will give you a good idea of what your home is worth. And if you would like a more precise estimate of what your home could sell for this fall, or if you have any other questions about the current real estate market, give me a call at 916-788-8822. I’m here to help. Have a great day, Chris DeMattei DeMattei Real Estate Team Keller Williams Realty 916-788-8822 chris@dematteiteam.com BRE – 01229332

You spend most of your day in your office so why not find ways to make it a more enjoyable place to be? Try a few of these simple tips to create a more inviting and relaxing office space. Change Up Your Lighting : Try getting a nice desk lamp and a floor lamp to help add warmer lighting instead of the overhead lighting that can be unpleasant to work under. Get Organized : A cluttered and disorganized workspace not only kills your productivity but it affects your creativity as well. Sort through the clutter and determine what on and near your desk must be moved, what must be there, what can go in the trash and what can be filed away. Create an official inbox where all your to-do’s go instead of having piles all over your desk. This will help you clear the clutter both physically and mentally. Make sure to select an attractive inbox, it will brighten up your space and your mood. You can find some great trays at Staples and even HomeGoods stores. For great shelving and organizing options you can also visit thecontainerstore.com. Decorate Your Space : Hanging artwork will give your office a more homelike feel. Select a print that is relaxing and appealing to you personally. You could also choose a metallic color to use as accent pieces throughout your office. Don’t be afraid to add some bold color and some whimsical elements to your office if that is what you like. Surround yourself with what inspires you and makes you happy. Add A Plant To Your workspace : Even just a small plant sitting on your desk will help improve the feel of your office. You can find some great pot selections at West Elm, Pottery Barn or even your local hardware store. Then select a plant that will thrive indoors with minimal watering and light. Some plant options for your desk include: A Spider Plant- theywill survive with low levels of light and only need to be watered every few days. Another option is a Snake Plant: These plants grow with low levels of light and can even stay alive in drought conditions so they are a perfect desk plant. Bamboo: this is another office plant that doesn’t require a lot of light and it adds a fun element to your desk. You spend most of your day in your office so why not make it a space you enjoy being in? Have some fun and get creative.

Many home owners ask, “What are the things I should or should not do to net the most money when I sell my home?” This is about your net bottom line after the sale, not the highest possible sales price. In order to get the highest sales price possible, a seller may need to do a complete remodel. Kitchen cabinets, counter tops, floors, remodeled bathrooms, etc. Depending on what resources are available to a seller, the odds are for every dollar spent on these upgrades, the seller will realize about a 50 to 75% return on investment. So the questions is, “What can you do to get a 100+% return?” Many home owners ask, “What are the things I should or should not do to net the most money when I sell my home?” This is about your net bottom line after the sale, not the highest possible sales price. In order to get the highest sales price possible, a seller may need to do a complete remodel. Kitchen cabinets, counter tops, floors, remodeled bathrooms, etc. Depending on what resources are available to a seller, the odds are for every dollar spent on these upgrades, the seller will realize about a 50 to 75% return on investment. So the questions is, “What can you do to get a 100+% return?” 5 Things – The 5 most important things you can do are as follows: Paint – There is nothing like a fresh coat of paint on the interior and exterior to make a house really shine. Paint is the least expensive thing you can do to brighten up a home. Fresh paint improves curb appeal and gives the interior a cheery, welcoming feel. Beware of some dos and don’ts about paint: use neutral colors so the home appeals to the broadest pool of buyers; make sure paint coverage is good to avoid a cheap, streaky look; and paint ceilings as well as trim, door and closets. Flooring – If carpets, linoleum, laminate floors are worn, these should be replaced, especially carpet. New carpet gives the home a fresh warm feel and look, and some buyers will want new carpet, especially if they have young children. Some sellers like the idea of a carpet or floor allowance to avoid the work and cost of installing new carpet and floors, which allows the buyer to choose their own color and style. This can be a good work around but it is not as good as new carpet or flooring. Many buyers have a hard time looking past worn or deteriorated floors. Therefore, the best solution is to replace if possible. Roof & Gutters – The roof and gutters need to be in good condition with usable life left. A simple roof inspection can determine what roof repairs are needed and if it can be certified. If it is certifiable, then it will qualify for all forms of financing. Beware, even if the roof is tile, it is still a good idea to have it inspected. Tiles crack or break and roof valleys can fill with tree leaves and other debris causing water to back up and eventually leak. Deferred Maintenance – Deferred maintenance refers to dry rotted wood, termites or other wood destroying insects, pealing paint, fences, deteriorated or damages sidewalks or driveway, etc. All these items should be addressed in order to net the most money possible. As a rule, if a home needs $5,000 in deferred maintenance repairs, a buyer is going to pay at least $5,000 less for the house. Sellers need to be aware that buyers do not want to buy their problems. . Did I say clean? A clean home screams to the buyer that the house has been well maintained and loved. When a buyer walks into a clean home, they are less likely to ask what is wrong with it. A clean home is also more inviting and comfortable. Seller’s that do these 5 things will get the most BANG for their BUCK and will sell their home faster with a lot less hassle. For more information on these tips or other real estate needs, call me, Chris DeMattei at 916-788-8822.

When it comes down to it, the most important advice a real estate agent can give sellers is how to price their home. No matter how beautiful or well-maintained a property may be, how many upgrades it has or how well it shows, if a home is not properly priced, it’s going to be a tough sell. The battle for agents most often lies with aligning what sellers’ think their home is worth with its true market value. These disparate realities can be difficult to merge when working with a seller to set a list price or on a price adjustment. Here are seven pricing myths that often get in the away. 1. It is better to price the home on the high side because the seller can always come down. If buyers are interested, they can make an offer. Well, not quite. If a home is overpriced, a seller risks losing potential buyers who aren’t stretching their search into an uncomfortable price range. The asking price sets the stage and may invite or dissuade buyers based on the dollar amount. As you would painstakingly prepare your home for sale, you never get a second chance to make a first impression price-wise. 2. If a home is priced just right, a seller risks leaving money on the table. Actually, the opposite is true. A well-priced home tends to generate a lot of interest and can result in multiple offers. A shorter marketing span brings strong offers that could result in a home selling for over asking price. Buyers are less likely to play “let’s make a deal” and nit-pick every little thing; they feel the urgency of competing with other interested parties for the same house. 3. The price gets better with time. If it doesn’t sell this time, the seller will get a better price by re-listing next spring, next summer, etc. It has been said before, but it needs to be said again: A home that sits is not like fine wine — it does not get better with time. The longer a home stays on the market, the more likely buyers are to question its value. Subsequently, any offers that come in tend to be perceived as too low by an already-frustrated seller who thinks there weren’t any buyers for their home while it was on the market the first time. Granted, some seasons can be better than others — and that really depends on where a home is geographically located. Trying to attract maximum traffic in the dead of winter may not be the best strategy, but if priced aggressively, a seller may just get that serious buyer who is ready to close. Waiting to re-list again may mean competing with other houses on the market that are both nicer and offer more bang for their buck. The additional carrying costs of a mortgage, maintenance and upkeep as well as the possibility of needing to make repairs to an aging roof or AC system eat into the profitability of commanding a better price next year. If the home is somewhat dated on the inside, price out the cost of replacing granite counters, updating appliances, repainting and other upgrades, and it will likely be much less expensive to adjust the price without as much hassle. 4. X price is as low as the seller will go. When faced with an offer that is less than what they want, sellers love to draw a line in the sand and dig their heels in over an arbitrary number that they deem to be “their bottom line.” Who decides what a property is ultimately worth anyway? Buyers see the glass as half empty versus half full, and in some markets and real estate cycles, they are holding the cards. Sellers can decline an offer based on a number, but they may never get there with another buyer, and a subsequent offer may be lower or layered with conditions and complications. 5. An offer should come in close to asking price. Sellers are often disappointed at the initial price when an offer is received and ask “why so low?” Does a seller really think a buyer is going to be generous with their initial offer? Unless it is a really hot property, priced aggressively or in a low-inventory market, no buyer is going to willingly offer more than they have to, especially on a first pass. They want to get a sense of the seller’s flexibility or lack thereof before deciding their next move. 6. Outdated features shouldn’t impact the selling price. So the home has “upgrades” circa 1990 with white melamine cabinets, beveled edge laminate counters and builder grade 12-by-12-inch tile with brass fixtures, and the seller expects the buyer to pay full asking price or close to it? Reality check! The buyers are looking at how much they are going to have to spend to bring the home up to today’s standards and are going to deduct accordingly when formulating an offer. 7. The buyer’s offer is simply too far off the asking price to counter. A bird in the hand is worth two in the bush. A buyer has stepped up and put pen to the paper with a proposal. An offer is an invitation to negotiate and begin discussions about the property. It can be easy to get offended, but it’s best to keep emotion out of negotiation as much as possible and work in good faith with what’s presented. Pricing a property is a delicate dance. The bottom line is that the market doesn’t guarantee as strong a price as sellers usually want or expect — unless the home is a highly sought after, rare type of property. This article is from Inman News and reprinted here. For more information on the proper pricing of your home, call or text Chris DeMattei at 916-788-8822.